- AdCap Growth Partners

- Posts

- The "Golden Age" Part III.

The "Golden Age" Part III.

Private Credit Takes a Bath in rue21

We’re sure you’ve heard by now: on May 2, 2024, PA-based New rue21 Holdco, Inc. (“rue21”) and five affiliates (collectively, the “debtors”) filed chapter 11 bankruptcy cases in the District of Delaware (Judge Shannon) — the latest in a recent wave of retail cases to whirl around the bankruptcy bin and the first repeat offender in quite some time.

But don’t be fooled.

While this may look like your run-of-the-mill retail bankruptcy story, it isn’t. Nope, it’s a story about the “golden age of private credit.” Let’s dig in.

Rue21 is a specialty fashion retailer geared primarily towards adolescent and young adults; it designs, sources, markets and sells its own merchandise; it leases 540 brick-and-mortar locations and has an e-commerce website rue21.com;** it leases its corporate headquarters in PA and its distribution center in WV. In other words, other than its merchandise and FF&E, it doesn’t really own anything other than some digital real estate and, lol, some intellectual property.

Now mind you, all of the foregoing is the result of years of work trying to fix this company. The basis behind the ‘17 filing was to “(i) further revamp its e-commerce strategy, (ii) improve the in-store experience, (iii) right-size the store footprint and lease portfolio, (iv) de-lever its capital structure, and (v) effectuate a long-term business plan under its relatively new management.” The capital structure was relatively straight forward. The post-emergence capital structure comprised of a $125mm ABL and a $50mm term loan. In total, the restructuring wiped out $700mm in debt, killed ~400 stores, and amounted to a private equity retail wipeout for Apax Partners.

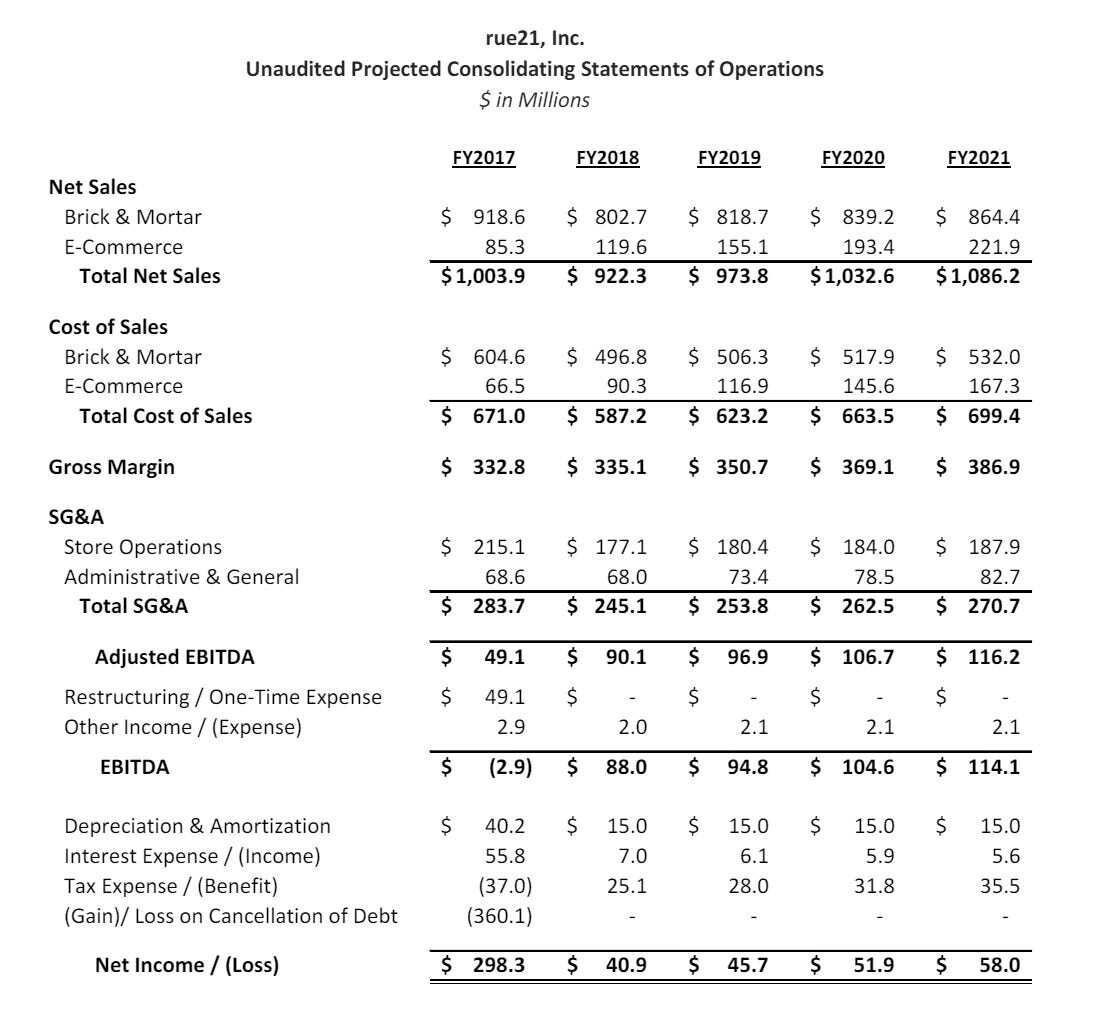

A few months later, the debtors popped back up on our radar after Reuters reported that the company sought more financing after an underwhelming holiday season. In May ‘18, the debtors announced that they had received a $20mm line of credit from Bank of America Merrill Lynch, upsizing the line of credit to $145mm. The next couple of years or so were relatively quiet heading into the pandemic. But then the pandemic hit and the company struggled to survive. Adjusted EBITDA for ‘20 and ‘21 came in at $62mm and $122mm, respectively, as the company “…renewed [its] focus on operational initiatives and margin improvement.” Compare this against the company’s financial projections from the ‘17 filing and, well, given the pandemic, performance wasn’t terribly far off!

Source: Docket 315. Case 17-22045

But it was still bad. The company had to refinance its capital structure in mid-’21, which is when it entered into its current ABL facility with Bank of America. That facility availed the company of $90mm (subject to borrowing base availability), including a $25mm letter of credit sublimit. This facility gave the ABL lenders a first priority interest but, critically, excluded equity interests and intellectual property.

But the pandemic had lasting effects and by mid-’22, the company desperately needed additional financing to survive.

Enter Blue Torch Capital LLC (“Blue Torch”).

Source: GIPHY

Blue Torch has been involved in a number of hairy restructuring names over the last year or so including, among others, Near Intelligence Inc. ($NIR) and Troika Media Group Inc ($TRKA). Like, these guys really ought to consider dropping “Torch” from their name lest they continue to remind investors how skillfully they incinerate cash. This situation? Well, it’s bad. Like, really bad. An all-timer, even.

In January ‘22, the company entered into an $85mm term loan credit agreement with Blue Torch secured by a first priority security interest and lien on the equity interests of rue21 and certain real and personal property (… remember, this company doesn’t own any real property). Blue Torch otherwise got a second priority lien on the ABL collateral (lol).

Of course, the company still struggled. And so in August ‘22, the company retained an investment banker to perform a capital raise to bolster liquidity. Where did the capital come from? Blue Torch!

Unfamiliar with the old saying “good money after bad,” Blue Torch agreed to torch “invest” an additional $25mm in the company in exchange for warrants that were subsequently exercised, giving Blue Torch ~80% ownership of rue21.

Did that do the trick? LOL, OF COURSE NOT. Let’s get after it:

Source: GIPHY

The $25mm of new money lasted 2 months…and these guys were like, “hey, let’s double down and 2x our exposure!”

So this is what the capital structure currently looks like — a reflection of BofA ratcheting down its exposure as Blue Torch upped its own.

Source: Docket 17

Behind the funded debt, there’s $65mm in unsecured claims.

All of which leaves us where, exactly?

Well, this sh*t show is liquidating.

The stated purpose of this bankruptcy is to liquidate the debtors, using the proceeds of going out of business (GOB) sales to fund the wind down and pay down the ABL. The debtors have hired Gordon Brothers Retail Partners LLC to effectuate some “GOB” sales over the next 4-6 weeks. You can see how this plays out in the debtors’ filed cash collateral budget:

Source: Docket 44

Based on this, it looks like BofA’s security interest in and lien on receivables will be just enough to cover the outstanding pre-petition ABL nut. Good for them!

How will Blue Torch fare? How much will it recover on its tens of millions of dollars infused into this situation?

Well, they have that security interest in the equity (ha… zero… donut) and the FF&E and intellectual property. Contemporaneous with the GOB sales, the debtors will attempt to sell those assets to maximize value for creditors.

There was some mention at the debtors’ first day hearing that there might be a bid for the IP out there but, if not, we’ll get the bidding started at 99 cents only.

| We are here to listen!

|

Meet the alternative path for capital.