- AdCap Growth Partners

- Posts

- News That Moves

News That Moves

Your Digestible Financial News

Digestible Financial News. Start your day with what's moving markets.

Please share the link below to others in your network that would be interested in subscribing to News That Moves: https://mailchi.mp/da858d099e24/ntm

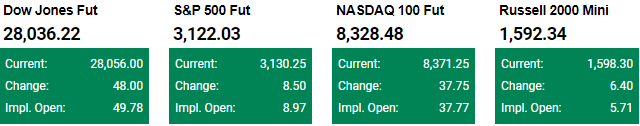

U.S. stock futures were higher despite mixed signals on U.S.-China trade talks and a sharp decline in Dow stock Home Depot.

Can TikTok overhaul its image?

The red-hot video app TikTok has taken a beating from U.S. lawmakers and regulators over accusations that it is exposing America’s youth to Communist Party indoctrination and smuggling their data to Beijing’s servers. But in an interview with Raymond Zhong of the NYT, the company’s C.E.O., Alex Zhu, talked about how he was trying to assuage Washington’s fears.

No, TikTok does not censor videos that displease China, he said. And no, it does not share user data with China, or even with its Beijing-based parent company.

But it’s unclear how such assurances will be received in Washington. This may explain why there is a raft of other possibilities reportedly floating around at TikTok to help improve its reputation.

In his NYT interview, Mr. Zhu did not rule out reorganizing TikTok as a separate company with a new board.

And TikTok has “reduced the amount of content from China that appears on the app, hoping to minimize reminders of its Chinese roots,” the WSJ reports.

Executives have also discussed “expanding operations in Southeast Asia, possibly Singapore — which would allow executives to distance the video-sharing app from China,” the WSJ adds, and also reportedly discussed “rebranding it in the U.S.”

Distancing TikTok from China “could be difficult to execute,” according to some investors in its parent company, ByteDance, who spoke to the WSJ. “But the discussions reflect how TikTok’s meteoric rise is under threat and how some close to the company increasingly view the company’s Chinese ownership as a liability,” the newspaper adds.

What’s next for T-Mobile’s C.E.O.?

T-Mobile announced yesterday that John Legere, its C.E.O. since 2012, would step down at the end of April after his contract expires, writes the NYT’s Edmund Lee.

Mr. Legere was credited with reviving the telecommunications company, by cutting prices and more than doubling its subscriber base.

And he did it with a flourish, making public appearances wearing bright magenta clothing and gleefully bashing T-Mobile’s rivals on social media.

His departure comes at a crucial time for T-Mobile, which is in the process of acquiring Sprint — a deal that will allow it to better compete with its larger rivals, Verizon and AT&T.

The merger will now be overseen by his successor, Mike Sievert, T-Mobile’s president and chief operating officer. Mr. Sievert is also expected to lead the combined company after the acquisition.

Mr. Legere’s departure could result in a big payday, with a potential exit package totaling an estimated $96 million, according to the research firm Equilar.

The news renewed speculation about a jump to WeWork for Mr. Legere, after reports circulated last week that the real estate company was considering hiring him as its leader. Mr. Legere cut down those rumors yesterday, saying he had not talked to WeWork about the job.

But Mr. Legere, 61, has no plans to retire: “I’ve got at least 30 or 40 years and at least five or six acts left in me.”

Are Trump’s on-off trade tactics working?

In recent months, President Trump has alternated displays of anger and warmth toward Beijing, pairing ambitious goals for a trade pact with even bigger threats should China not accede to his terms. How’s that going?, asks Ana Swanson of the NYT.

Despite claims that a “Phase 1” trade agreement has been reached, Mr. Trump appears to be having some difficulty actually signing a deal with China.

“The two sides have been unable to reschedule a meeting between Mr. Trump and his Chinese counterpart, Xi Jinping, in Chile that was canceled because of domestic protests,” Ms. Swanson writes.

“Without a set deadline, the two sides have lost a source of external pressure to get the deal done.”

And Chinese officials are nervous about the effect that Mr. Trump’s seesawing could have:

“Mr. Trump’s tendency to waver and increase his demands have made China wary of offering concessions, for fear that he will only demand more, people familiar with Chinese trade policy said.”

They fear that if Mr. Trump gives fewer concessions than they anticipate, it could result “in an embarrassing trip for Mr. Xi, according to people familiar with their thinking.”

There is some hope that an agreement could be finalized in the next few weeks. But with trade uncertainty weighing on the economies of the U.S. and China, businesses will be hoping that Mr. Trump’s hot-and-cold approach does not undermine that possibility.

Stocks to Watch

Shares of Coty (COTY) are up slightly after the beauty company said it's paying $600 million for a majority stake in Kylie Jenner's makeup and skincare business.Thousands of Disney+ (DIS) user accounts have been stolen by hackers and put up for sale on the dark web, according to multiple reports.American Express (AXP) is offering bonuses up to about $450,000 to businesses to get them to start taking its cards, according to The Wall Street Journal, which called the effort a way to catch up with Visa (V) and Mastercard (MC).